fLAB fUNDS ESG Approach

- From March 10, 2021, the main parts of the European Sustainable Finance Disclosure Regulation ((EU) 2019/2088 – SFDR) apply.

- Investor demand is rising for strategies that integrate environmental, social or governance (ESG) considerations with financial objectives.

- Taking such an approach, using S&P Global Corporate Sustainability Analysis for Equity Screening and MSCI ESG Government Ratings for Bonds Screening, meaningfully improves the ESG characteristics of our funds, fLAB Core and fLAB Equity, without significantly altering the risk-return profile.

You can find here the Sustainability reports of our funds:

In accordance with article 8 of EU Sustainable Finance Disclosure Regulation, fLAB Core and fLAB Equity promote environmental and social characteristics.

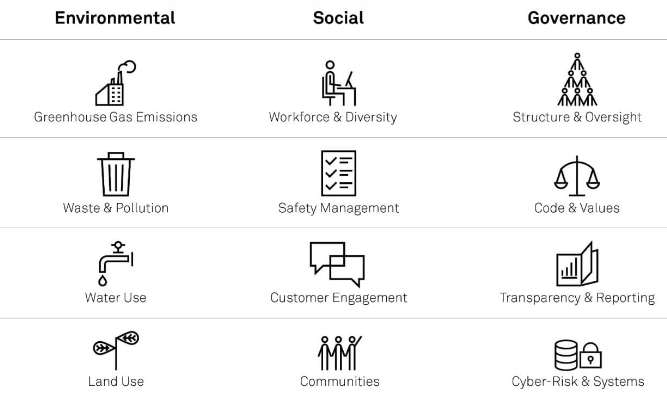

Exclusion filters are applied to the portfolio construction process to restrict investments in companies and issuers with significant exposure to certain activities deemed to be detrimental to the environment or the society at large. Such approach notably exclude all companies that are allegedly involved in breaches of international law and norms on environmental protection, human rights, labour standards and anti-corruption

Our investment process includes ESG factors using a “best-in-class” approach in order to identify those companies with the best practice and standards in terms of ESG and sustainable development for inclusion in the portfolio. ESG criteria is integrated as part of the quantitative investment process for stock selection. The model penalizes issuers with low relative rating.

Sustainability risks are integrated into the investment decision by following the S&P Global Corporate Sustainability Assessment (the “S&P Global CSA”) for all investments in equity securities (in the United States and in the Euro Zone). The S&P Global CSA, provided by Bloomberg, serves as a sustainability roadmap helping participating companies to prioritize corporate sustainability initiatives that are most likely to enhance the company’s competitiveness.

Both funds use the S&P Global CSA ranking as follows: for each equity sector where we invest in the United States, Europe and Japan, we use the ranking as another factor for stock selection, overweighting the companies with the best ranks and underweighting the companies with the lowest. The Sub-funds will not be invested in any company under the 33% rank.

fLAB Core also uses the MSCI ESG Government Rating for government bonds and will not invest in bonds with rating under BB as rated by the MSCI ESG Government Rating. MSCI ESG Government Ratings identify a country’s exposure to and management of environmental, social, and governance (ESG) risk factors and explain how these factors might impact the long-term sustainability of its economy. By providing a long-term view on sustainability the ratings aim to complement traditional government debt analysis for analysing a country’s credit worthiness.

Good governance practices

In order to assess good governance practices, fLAB Core and fLAB Equity follow two proprietary indicators from Bloomberg: The BESG Governance Pillar Score and the BESG Board Composition Theme Score.

The BESG Governance Pillar Score measures each company overall governance performance.

The BESG Board Composition Theme Score enables investors to assess how well a board is positioned to provide diverse perspectives and supervision of management, as well as to assess potential risks in the current board structure across four key focus areas: diversity, tenure, overboarding and independence.

These two quantitative models are designed by Bloomberg governance specialists and utilises Bloomberg’s management and board level data. The scores range from 0-10 and-rank the relative performance of companies. fLAB Core and fLAB Equity will monitor these scores and will favour those stocks within the first two quartiles.