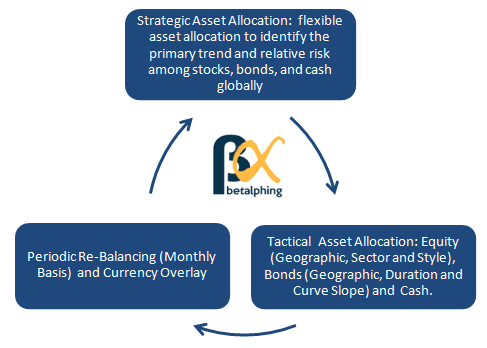

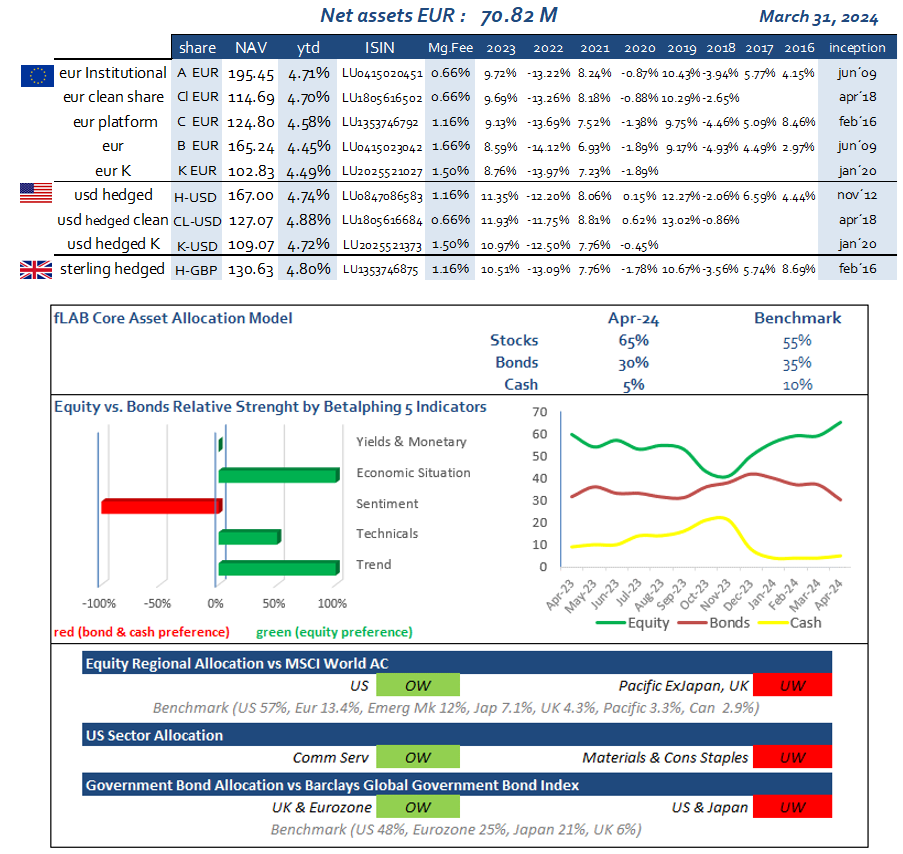

1) Strategically guided monthly asset allocation step:

A monthly Stock/Bond Model first generates the allocation to stocks, and then the balance of the portfolio is allocated between bonds and cash based on the reading of the Bond/Cash Model.

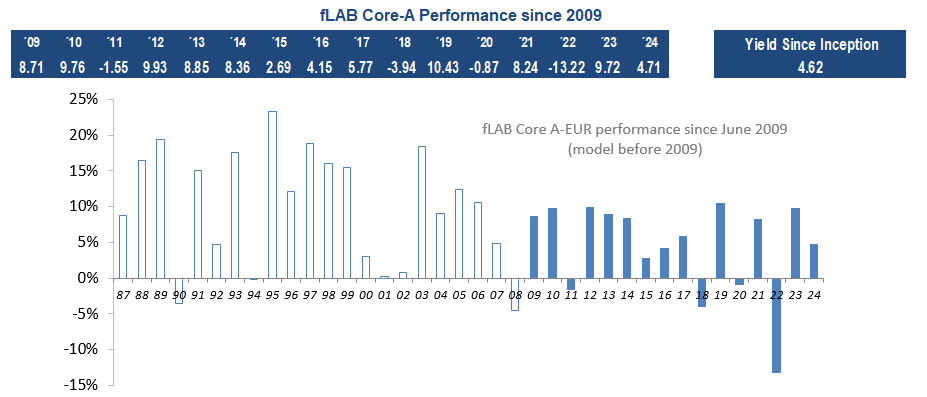

Stock returns are proxied by the MSCI World Total Return Index, bonds by the Barclay’s Global Long Term Treasury Total Return Index and cash returns are proxied by an equal-weighted average of the total returns of three-month Treasury securities from the U.S., Japan, U.K., Canada, and the Euro-Zone.

Benchmark used is 55-35-10

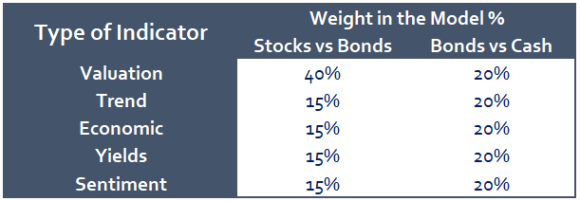

Model Transparency: The allocation indicators that we use for our Asset Allocation are the key point of our Fusion Analysis. They are a perfect sample of our 5 types of analysis: trend, valuation, sentiment, economic & interest rate indicators.

In a first step, when we allocate between Equity vs. Bonds, the Valuation Indicators weigh 40% of the model. All the other four types of Indicators weigh 60%. If you need further information about our model, please visit www.betalphing.com

2) Tactical Asset Allocation Step:

Once we have designed the Monthly Asset Allocation, we run our sub-models:

-

The Sector and Geo Equity Models to allocate between Sectors and Countries

-

The Bond Geographical and Duration Model: Countries and curve strategy

-

The Currency Hedge Overlay Model