fLAB Equity : A Dynamic World-Equity, Multi-Factor, Sector-Neutral Approach

In recent years, institutional investors have employed a new approach to Equity portfolio construction: factor-based investing. This increasingly popular approach lies between passive and active investing, allowing investors to target specific risk factors as well as market beta.

Factors are the primary market drivers of Equity returns. Only a few set of rewarded factors are backed by academic consensus:

- Quality: Average of trailing 12-month Return on Invested Capital (ROIC) and Return on Equity (ROE) and Interest Coverage Ratio

- Momentum: Average of the trailing 6 and 12-month total returns

- Low Volatility: Average of the trailing 6 and 12-month standard deviation.

- Value: Average of trailing 12-month EBITDA to Price and Revenue to Price.

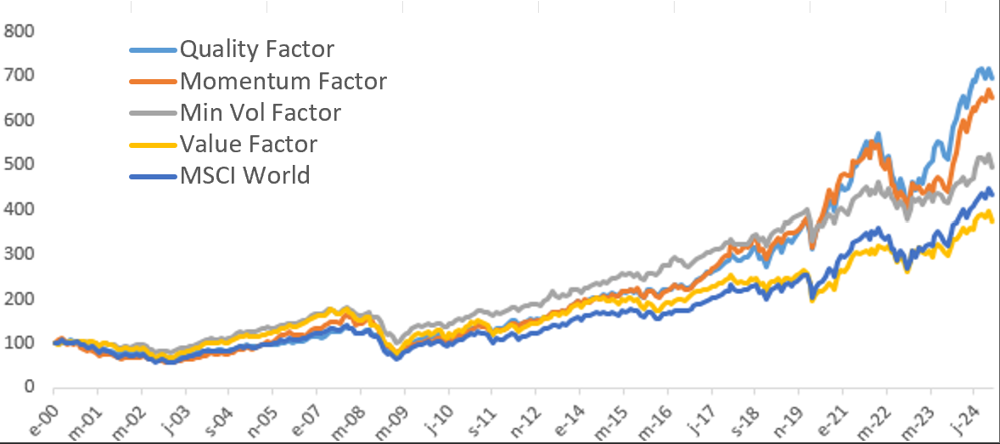

We have found out that the best factor combination (Absolute Performance, Sharpe Ratio & Maximum Drawdown) since the launch of real pure factor investing strategies (Jan 1999) has not been constant. In fact, world factor performance has been impressive vs. MSCI World but quite divergent:

The Sub-Fund aims to achieve capital growth over the long term by investing in a selection of shares in leading global companies with enduring competitive advantages and a long runway of growth.

The Sub-Fund aims to provide long-term capital growth through a global, dynamic equity portfolio. Combining factors through a multi-factor allocation reduces the variability in performance through diversification and results in long-term historical outperformance.

The investments in the Sub-Fund are subject to market fluctuations and to risks inherent to all portfolio investments; including market risks, interest rate risks, credit risk, currency risks and sustainability risks. All risks can be found in the Prospectus.

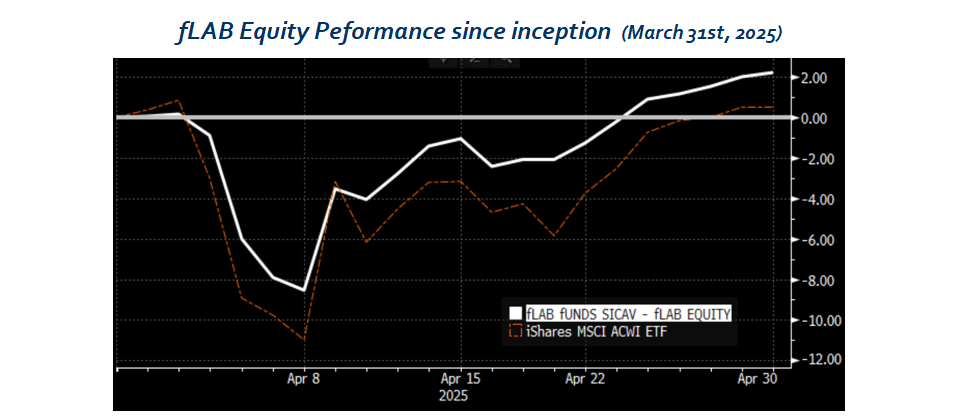

fLAB Equity is an actively managed equity fund that aims to beat MSCI ACWI, with an absolute degree of freedom.

Adapting multi-factor allocations

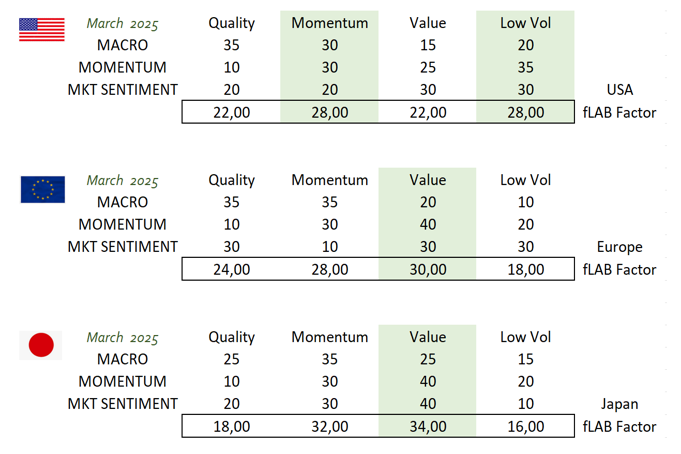

Each quarter, for each geographic area, we will choose those stocks with the best 4 factors combination depending on:

- the macro cycle

- the own 4 factors momentum

- the market sentiment (risk On/Off), measured by credit spreads and volatility curves

You can find a glossary with the definitions and meaning of technical terms here:

Financial Terms Glossary

The rebalancing is quarterly made in the 3 geographic areas. The resulting portfolio, with the best stocks by factors is forced to be Sector Neutral against its index using our Portfolio Optimizer. That is, we will have a stock portfolio that will be almost identical in sector weighting to MSCI World but with those stocks that have the best factor combination and therefore, a greater probability of success.

fLAB Equity fills a niche market that does not currently exist (and with low management fees) and can perfectly replace investments in global Equity, whether through ETFs or Investment Funds.

How do we create our fLAB Equity portfolio?

85% of the MSCI AC World Index (United States, Europe and Japan):

- As Article 8 SFDR UCITS Fund, the worst ranked shares in ESG compliance will be removed, as well as those included in our Exclusion List.

- Screening of the large-mid cap stock universe in these Geographic Areas (S&P500, Europe 350, Nikkei 225) using our fLAB Factor Model, will select the best stocks in each of the GICS Sectors, to create our Investable Universe.

- For each of these 3 main markets, the Portfolio Optimizer will find the best final combination of stocks with the following constraints:

- A Maximum % Active Risk vs each Benchmark (S&P 500, Europe 350, and Nikkei 225)

- Full GICS Sector Neutrality (+/- 0.25% for each sector)

- Maximum % allocation per share

- Final Picks: 60 stocks in USA, 22 in Europe and 18 in Japan

(These constraints could be slightly modified to optimize the final portfolio).

15% of the MSCI World Index (Emerging Markets and Asia Pacific ex-Japan) will be invested through UCITS ETFs (max 10%) and Index Futures

In accordance with article 8 of SFDR, the Sub-Fund promotes environmental or social characteristics.