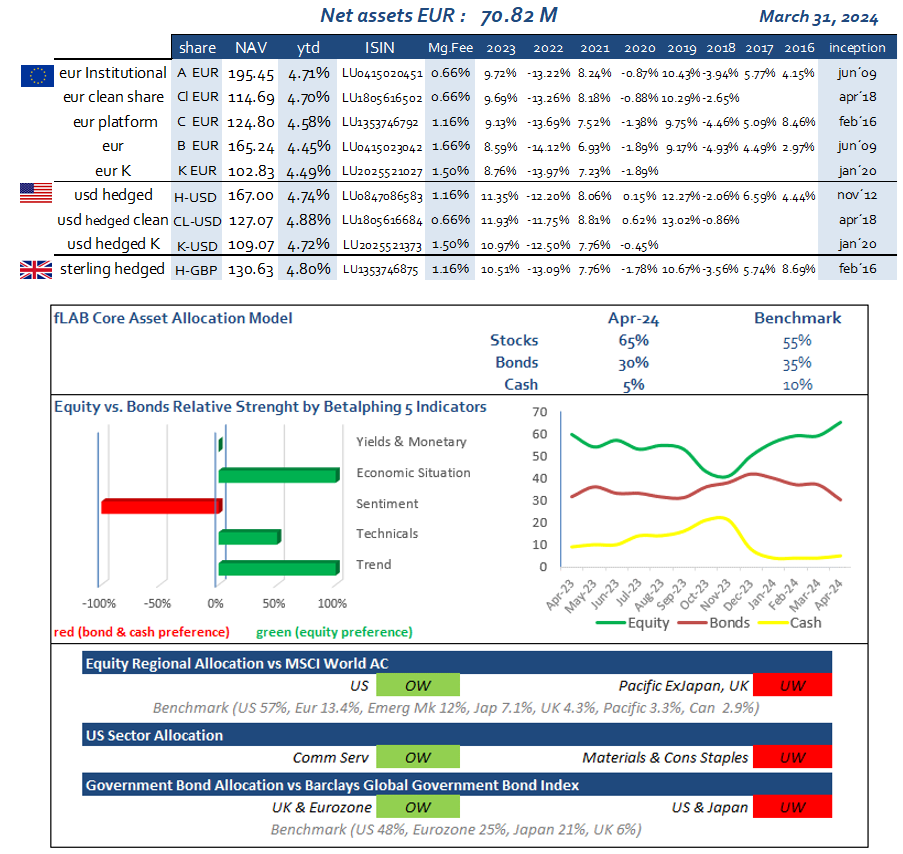

fLAB Core : Global Flexible Asset Allocation Fund through Betalphing©

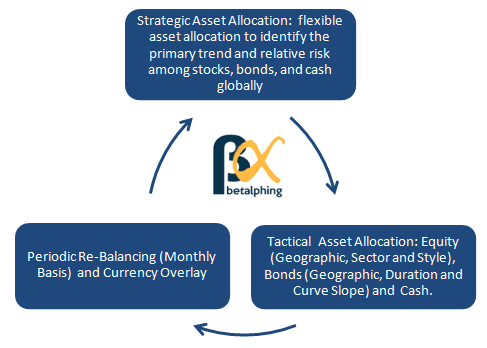

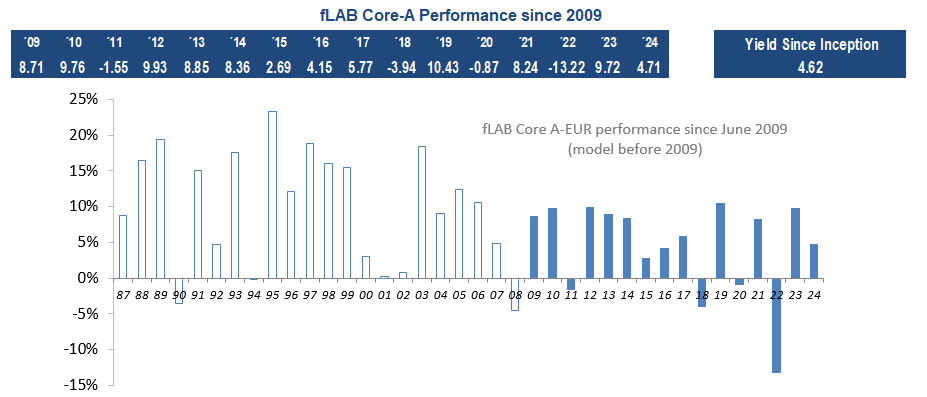

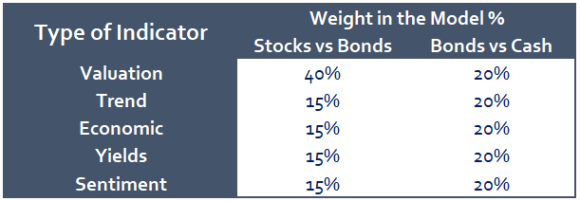

fLAB Core aims to provide long-term capital growth through a global, flexible and dynamic balanced portfolio. The portfolio management is based on a proprietary guided asset allocation model, (Betalphing©), designed to identify the primary trends and relative risks among the three traditional asset classes: Stocks, bonds and cash. By combining multiple indicators, Betalphing© generates an optimal allocation between these three asset classes.

The investments in the Sub-Fund are subject to market fluctuations and to risks inherent to all portfolio investments; including market risks, interest rate risks, credit risk, currency risks and sustainability risks. All risks can be found in the Prospectus.