fLAB Satellite : Dynamic and Global Flexible Relative Return Fund

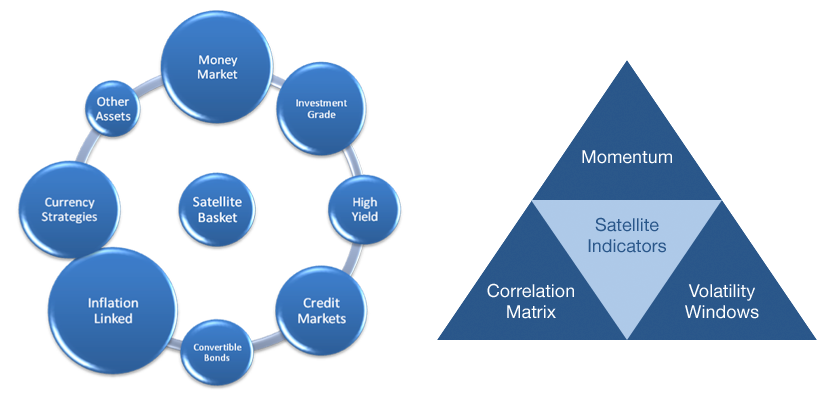

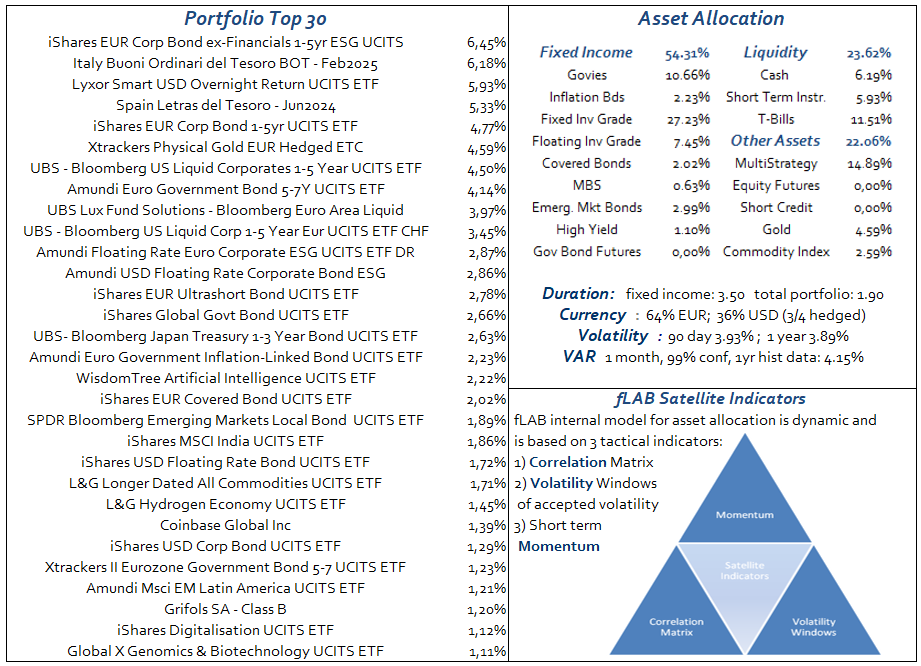

Asset Allocation is the center of all our decisions. We know that the key element to produce consistent returns is building a Disciplined, Global and Flexible Asset Allocation.

We know Absolute Return Funds are quite popular, but we think most of them are quiet inefficient. They were created when interest rates were between 3% and 5%. At that time, offering Libor+200bp was usual and achievable if the Manager had the right skills.

Now at current situation, when World Risk-Free Rates are 0% or even negative, we think that offering this type of Absolute Return Funds, trying to deliver hundred times the current Risk Free Rate is not feasible.

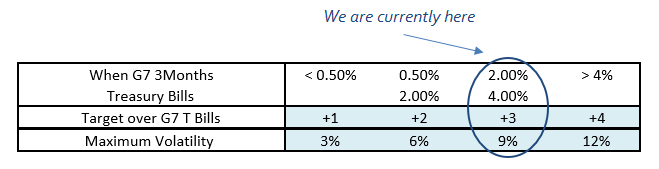

Risk-free rates change. We cannot affirm we will achieve T-Bills + 3%, under any level of risk-free rate. We have to adapt our target dynamically. That´s why the excess return we try to obtain above T-Bills changes, as we adapt to different levels of maximum accepted volatility

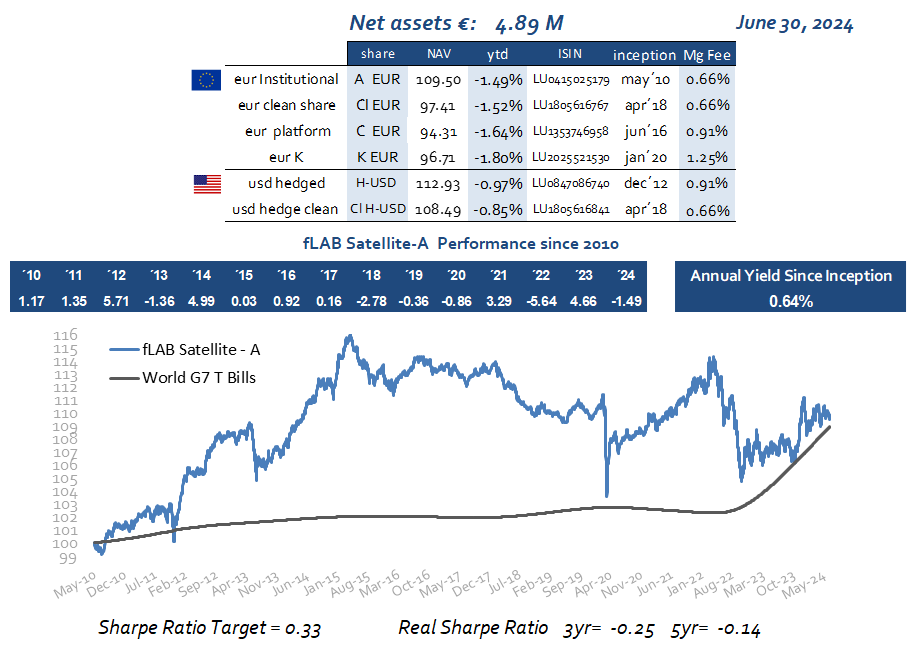

We have created a new fund concept: a Relative Return Fund with a Minimum Sharpe Ratio Target. In a game of non-stable correlations, fLAB Satellite role is to try and find the best combination between assets to provide positive relative returns. In essence, fLAB Satellite target is to maximize the Sharpe Ratio.